There are numerous methods through which you can invest in residential or commercial property. Carry on reading to get more information about this.

From affordable ventures like purchasing inexpensive apartments or condominiums outside the city to acquiring blocks of flats at the very heart of the city, real estate investment can take various shapes and types. Larger real estate companies usually focus on development projects that include building residential or commercial properties from the ground up and selling or renting them at a later phase. At present, the latest patterns in the real estate sector focus on building giant complexes like shopping malls and dividing the area into smaller sized units to be leased to private business renters. These projects are understood to be extremely rewarding as instead of selling the space for a profit, financiers charge rent in perpetuity, taking pleasure in stable and repeating earnings instead of a one-off gain. Companies like the activist investor of Hammerson would likely confirm that these projects need substantial seed capital and careful planning, but financiers can likewise expect a huge payday.

While investing in property stays an appealing idea no matter the type, there are some key elements that identify and influence residential or commercial property value. For instance, the more standard parameters focus on the concept of supply and demand. In practical terms, if a location has seen numerous brand-new builds in recent years, this is typically an indication of increased demand for stated properties to be established, making financial investment in such ventures a fulfilling path. From an investor's viewpoint, location is amongst the most essential components that affect market value. In this context, any real estate agent would inform you that 2 identical listings in different locations can be priced very differently. Investors like the fund with shares in Segro would likely agree that this is just due to the fact that people are more likely to pay more for residential or commercial properties found in prime areas, which are well-connected to public transport links or are considered much safer than others.

Residential or commercial property financial investment has always been among the most desired business endeavours as with a great selection of properties, financiers can anticipate to make considerable profits. In fact, beyond this, the real estate business can help open lots of advantages as owned property produces a stable cash flow that can be utilised to enhance other residential or commercial properties. Furthermore, because owning and maintaining properties can sustain substantial charges over extended time periods, financiers can take advantage of much-needed tax breaks by deducting the expense of maintaining and managing a property-- be it residential or industrial-- which assists lower their taxed earnings. Another benefit to investing in domestic or industrial property is the appreciation of property over time, and firms like the activist stockholder of Prologis would agree that not only does the value of property tend to increase, but profits can also be made in the interim through tenancy agreements.

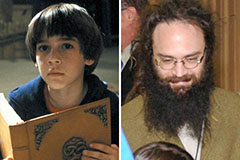

Barret Oliver Then & Now!

Barret Oliver Then & Now! Anthony Michael Hall Then & Now!

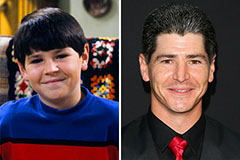

Anthony Michael Hall Then & Now! Michael Fishman Then & Now!

Michael Fishman Then & Now! Barry Watson Then & Now!

Barry Watson Then & Now! Danny Pintauro Then & Now!

Danny Pintauro Then & Now!